Lower mortgage rates in September had a measurable impact on home sales.

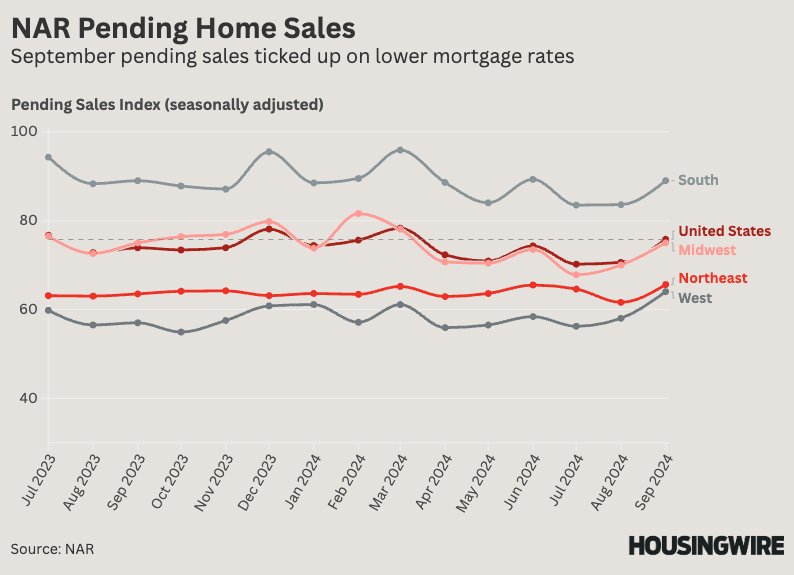

According to data released Wednesday by the National Association of Realtors (NAR), pending home sales in September jumped 7.4% compared to August and 2.6% year over year. NAR’s index reading of 75.8 is the highest number since March. An index reading of 100 equates to sales activity in 2001.

“A slight improvement in pending-sales activity reflects August’s sharp decline in mortgage rates, which helped boost housing demand and provide some much-needed consumer optimism, particularly for the purchase of big items,” CoreLogic chief economist Selma Hepp said in a statement.

“However, with rates pushing back to 7%, the rebound in pending activity is likely short lived and is unlikely to be enough to help 2024 home sales exceed 2023 levels.”

The jump in pending sales occurred in all four regions of the county, with the West leading the way with a 9.8% monthly gain, followed by the Midwest (+7.1%), the South (+6.7%) and the Northeast (+6.5%). The South’s index reading of 89 is by far the highest of the four regions, with the Midwest next at 75, followed by the Northeast (65.6) and the West (64).

NAR’s data release also includes a forecast. Chief economist Lawrence Yun said that over the next two years, he expects home-price growth to slow, which will also boost sales.

Pending home sales data is the latest sign that falling mortgage rates in August and September boosted home sales. In the U.S. Census Bureau’s new-home sales report for September, sales jumped 4.1% compared to August and 6.3% year over year.

But NAR’s existing-home sales report for September showed sales falling 2.5% from August and 3.5% year over year. The S&P CoreLogic Case-Shiller home-price index for August showed a slowing appreciation rate as a result of mortgage rates dropping during the month.