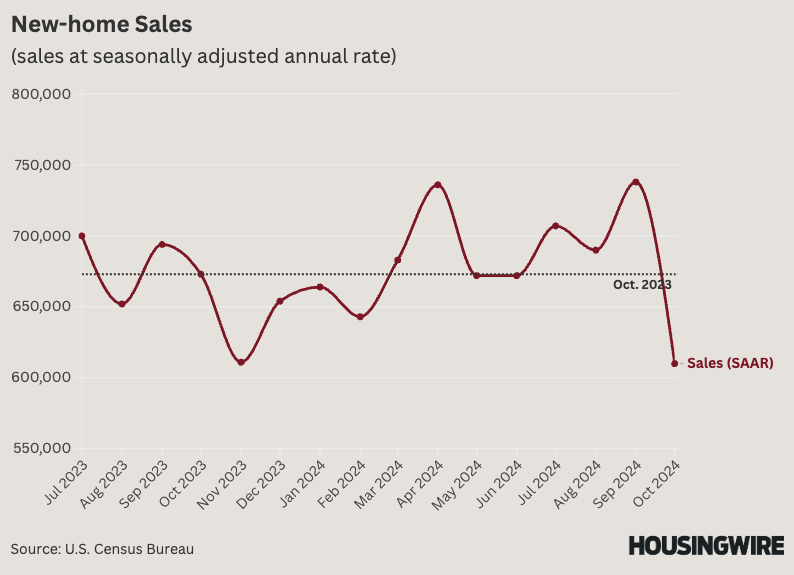

After a year of strong results, sales of newly built homes took a major step back last month.

Data released Tuesday by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD) shows new-home sales in October clocking in at a seasonally adjusted annual rate of 610,000 — a 17.3% decline compared to September and a 9.4% decline year over year.

The numbers represent the slowest pace of new-home sales since November 2022, when the seasonally adjusted annual rate was 596,000. The post-pandemic low point occurred in July 2022, when the rate fell to 519,000.

The median sale price of a new home hit $437,300, a 4.7% annual increase. Months of supply at the current sales rate was 9.5 in October, up from 7.9 months at this time last year.

Economists point to the October surge in mortgage rates and the rise in existing-home inventory as some of the factors behind the disappointing results for new-home sales.

”Some of the dip in new home sales in October is partially explained by political uncertainty,” Bright MLS chief economist Lisa Sturtevant said in a statement. “Following the election, home builders appear to be more confident as the home builder confidence index has risen for two months in a row.”

Existing-home inventory in October rose 19.1%, giving home shoppers considerably more options as an alternative to a new home. This could put a ceiling on new-home sales in the near term, although the ability to offer mortgage rate buydowns still gives builders an advantage over many existing-home sellers.

Regionally speaking, new-home sales have flipped directions. The South had been posting strong gains, but sales in October fell to a seasonally adjusted annual rate of 339,000, down 27.7% month over month and 19.7% year over year. It’s the slowest rate of sales in the South since April 2020 at the onset of the COVID-19 pandemic.

Conversely, the Northeast tallied strong gains in October after months of sagging numbers. Its October pace came in at 46,000, up 53.3% from the prior month and 35.3% above year-ago levels.

The sales pace in the Midwest rose 1.4% compared to September and 15.9% annually, while the West slowed by 9% month over month and 1.3% year over year.

“Builders continue to grapple with supply-side challenges and ‘higher-for-longer than we expected’ mortgage rates, which are a major headwind for builders and potential home buyers alike,” First American deputy chief economist Odeta Kushi said in a statement. “Despite the challenges, the new-home market will likely continue to outperform the existing-home market over the near term because, unlike existing homeowners, builders are not rate locked-in.”