Neon has raised $14 million in funding to build its direct-to-consumer digital store platform to help make game companies more independent.

The investors include Thrive Capital, Renegade Partners, Griffin Gaming Partners, a16z Games, Max Levchin’s SciFi VC and Ribbit Capital. San Francisco-based Neon will be doubling its team over the months to come while accelerating investment in its product and go-to-market efforts.

Neon’s team has a wealth of fintech, gaming, and ecommerce expertise having built and scaled products at Affirm, Apple Pay, Blend, Meta, Supercell, Unity, Netflix, Roblox, Walmart and more.

Direct-to-consumer digital stores are catching on in part because of the conflict between Epic Games and the Google Play and Apple App Stores over the 30% royalties those platforms charge developers for every sale of a game or game item. By bypassing them and going to stores like those offered by Xsolla, Coda, Fastspring and now Neon, those developers can get by with 5% fees, said Chris Faught, CEO of Neon in an interview with GamesBeat.

“Our view is that all of the regulatory actions and the app store policy changes that have occurred since 2021 and continue to unfold represent an inflection point for the games industry,” Faught said. “For the first time since the early 80s, when third party developer industry itself was born, these changes present every game creator with an opportunity to become a brand of their own. They can actually step out from behind hardware platforms and app stores to whom they’ve been suppliers for the last 40 years, and not only build a direct relationship with their players, but also sell to them directly.”

Founded in early 2022, Neon is a modern direct-to-consumer platform built for games. Neon’s mission is to accelerate the gaming industry’s shift to a more competitive, fair, and open ecosystem by building fintech and commerce tools that help gamemakers become enduring brands.

“When you combine this regulatory driven opportunity with the very many other technology tailwinds, like the push for more cross-platform games, advancements in streaming, WebGL, AI, and Web3 gaming — when you combine all of those things, this points to a future where the industry is far more centered around the people who make and play games, developers and players, versus one that’s just centered around the platform,” said Faught. “It will be a fundamentally better and large market because it will be more open, fair and competitive.”

Asked about who the company is targeting, Faught said is targeting game studios with anywhere from $100 million in revenue to $500 million in revenue.

What problem is it solving?

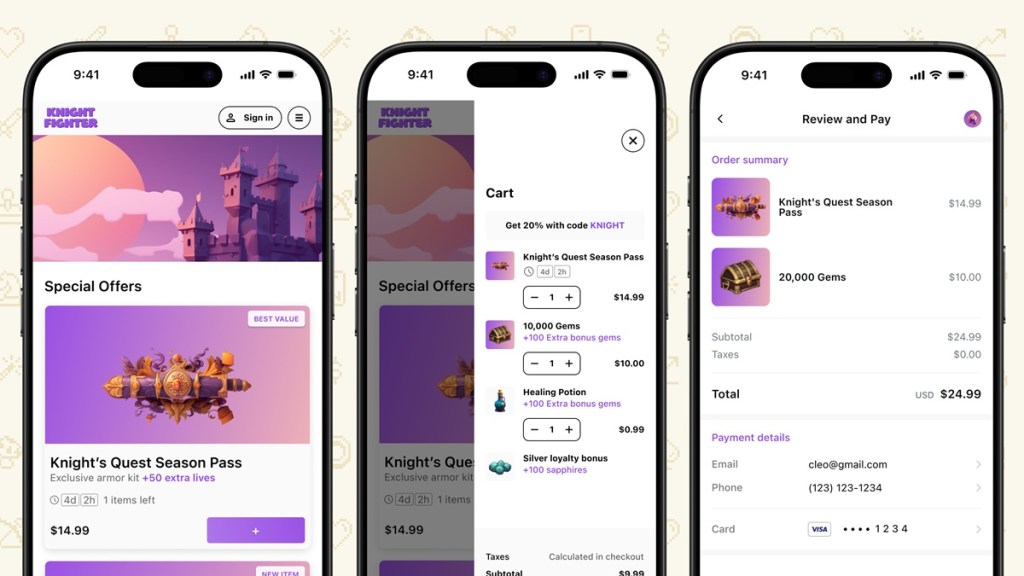

Neon helps game studios keep more revenue and build direct relationships with their players by supplementing their in-game (app store-based) monetization with their own D2C ecommerce channel.

Neon’s fully-customizable web shops leverage the best from ecommerce to ensure the player journey between game and web is seamless and conversion-optimized. Its APIs let studios port their rich liveops features and segmentations to their webstore, giving players an experience that’s personalized, immersive and consistent.

And as a “merchant of record,” Neon handles all complexities associated with payments, tax, fraud, currency exchange, and support across 45 markets, so players can buy how they want, while studios focus on doing what they love: creating the best games for them, Faught said.

It’s not going to be an easy fight.

“The reality is that future is not guaranteed because what we’re ultimately talking about is changing consumer behavior,” Faught said. “We’re talking about consumers engaging directly with the Supercells of the world, or the Scopelys of the world, instead of just Apple, Google, Xbox, Steam, PlayStation, etc.”

Why Neon is here

App Stores have been under constant regulatory scrutiny for the better part of the past decade for their restrictive, anticompetitive, and self-preferencing behaviors.

In 2021, Apple reconfirmed its commitment to the developer community that anyone is allowed to have their own out-of-app monetization channel that isn’t subject to their fees (this is what Neon has built), while the battles over opening up alternative in-app payment methods, along with giving developers the ability to link to their out-of-app monetization channels continue to rage on.

In addition to the app store pressures, the gaming industry writ large continues to evolve toward a platform-agnostic world because advances in gaming tech like streaming and WebGL increasingly erode the advantages or necessity of having dedicated gaming hardware/consoles.

On top of that, regulations surrounding industry consolidation (e.g., MSFT<>ATVI) is forcing the hardware platform owners/operators (Xbox, Playstation, etc) to allow for cross-platform support for games. And Microsoft is considering putting its cloud gaming service on top of Google Play, thanks to the verdict in the Epic Games versus Google antitrust case.

Platforms are evolving their own strategies and business models to support a cross-platform game. That is, they’re focusing on monetizing their unique IP as broadly as they can vs. selling hardware and their exclusive content. Faught believes all of these tailwinds point to a future where the gaming industry is far more developer and player-centric than hardware or platform-centric.

Neon specifics

Neon’s total purchase volume has grown 12 times every quarter for the past year, as its network of partners continue to drive anywhere from 10% to 35%+ of their total revenue through their Neon-powered direct-to-consumer channel.

Neon currently partners with a variety of mobile and PC studios and publishers around the globe, including Metacore, Theorycraft, Space Ape Games, PerBlue Entertainment, and more.

The D2C average order value is climbing. Neon’s partners see two times to four times higher average order value on purchases made on their Neon-powered webstore vs their in-game purchases. And over one-third of players who purchase on a Neon-powered webstore make multiple purchases each month.

In one experiment, a Neon partner found that 20% of their total purchasers came from net-new spenders on their D2C store (i.e., they’ve never converted in-game before). Neon has also seen up to 45% of monthly purchases through payment methods not supported by app stores.

Game devs can sell their games all over the world and use the payment methods that they want, without incurring the massive compliance headache or overhead to do so, Faught said.

“This is a really hard FinTech problem to solve. We solve it by taking what we think of as a modern approach to a merchant of record solution, where we’re the ones who handle sales tax, and we integrate all the local and global payment processors,” he said. “We manage fraud and data privacy requirements. We do all the post purchase support for players. So, again, the developer doesn’t need to do those things themselves. But the hard part of that is actually optimizing the performance of that solution.”

Looking to the future

Regarding cryptocurrency transactions, Faught said the promise of crypto in moving money internationally is attractive. He doesn’t think it is entirely ready yet, but it could be in the not-so=distant future. As more consumers want to pay with crypto assets, Faught said crypto payments will move forward on his company’s roadmap. But it’s not available now.

“It’s not our starting point,” he said. “Players are still using traditional payment methods. By expanding from debit and credit cars to payments like PayPal or other local wallets, we’re expanding the addressable market for our developers.”

Customers are drawn to the D2C web shops because of the chance to own the relationship with a player, he said. In that position, the game developer can make offers in a live service game to give players a better promotion or deal, Faught said.

“It’s a pretty heavy investment we’re continuing to make into our APIs to make sure we can support all those offers and offer tooling and compliance and analytics infrastructure,” Faught said.

The company is helping developers understand where the players are coming from, their purchasing behavior on the web, and then build a profile of the player so developers can understand their gamers with solid analytics, he said.

It’s not clear how things will unfold like Microsoft’s plan to take its store and cloud gaming service on top of the Google Play store. But Faught will be watching it closely.

Source link