In 2020, the U.S. Supreme Court empowered the president to fire the CFPB director at will, something that Biden took advantage when entering office in January 2021. It was widely expected that Chopra would follow the actions of his predecessor, Kathleen Kraninger, who left the bureau on Inauguration Day in 2021.

But Chopra said that there are a lot of “investigations in the pipeline,” and regardless of how things ultimately shake out for him, he hopes that the president follows through on a campaign promise to cap credit card interest rates at 10%.

“While working Americans catch up, we’re going to put a temporary cap on credit card interest rates,” Trump said at a campaign rally this past fall. “We’re going to cap it at around 10%. We can’t let them make 25% and 30%.”

In the meantime, the CFPB under Chopra’s leadership is continuing to push out guidance. On Thursday, the bureau published a report about an increase in the rate of auto repossessions at the end 2022, when the rate rose above pre-pandemic levels. The report includes a comment from Chopra.

Prior reporting from the Financial Times and The Wall Street Journal suggests that Trump transition officials were encountering challenges in locating a candidate to succeed Chopra as CFPB director. The Financial Times described the hunt for a new CFPB director as fraught, saying that multiple “experienced candidates” have opted not to enter the selection process when reached about potentially serving in the role.

But many do not expect Chopra to be a long-term fixture in the new Trump administration, possibly including the director himself.

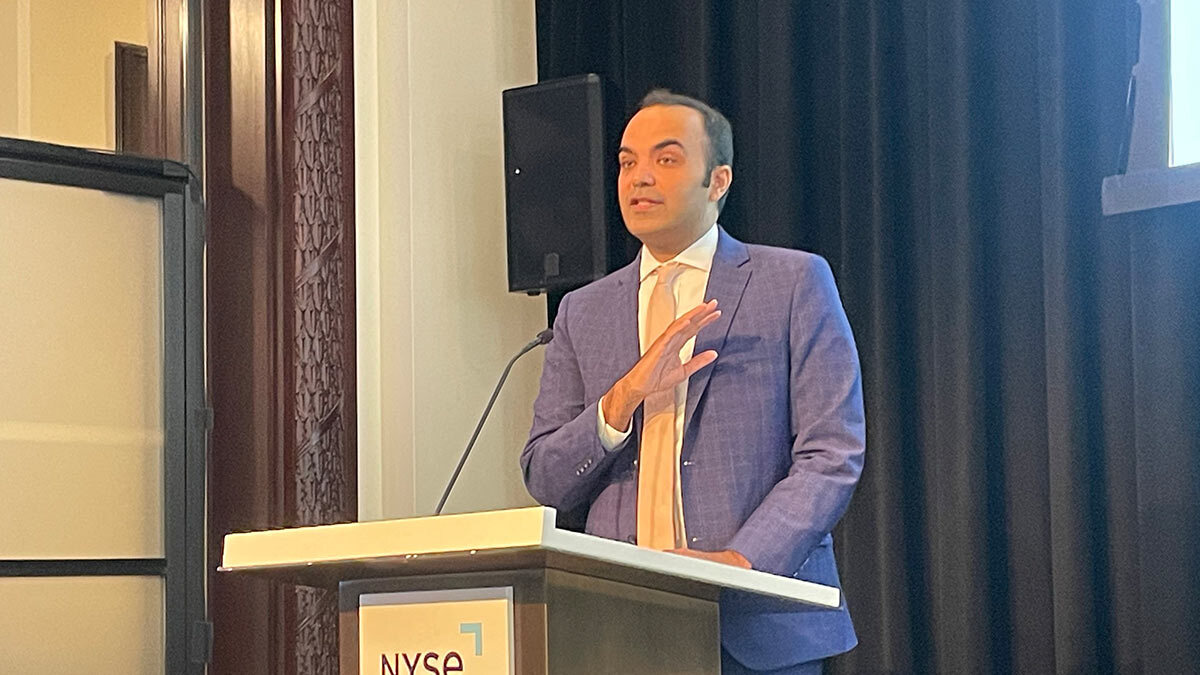

“As you know, we serve and are confirmed for a five-year term,” Chopra said during a Senate Banking Committee hearing last month. “The president can remove us at any time, any day, and we obviously completely respect that right.”